- Home

- Resource

- Buying a House

BUYING A HOUSE

Many people think that buying a house is a lot to ask for, especially if you are a first-time home buyer. However, if you set your expectations before buying a house, do your homework properly, and find the right realtor and the mortgage lender, the home buying process could be less stressful or confusing.According to the National Association of REALTORS®, only 10% of new home buyers buy a home with cash. Most of the new home buyers have to borrow some money through financial institutions to purchase their new home.

The key to becoming a smart new home buyer is knowledge. It could be a lot less stressful and intimidating if you have the right information and knowledge about buying a house. If you are a first-time homebuyer, you might have to be a little more observant and try to get as much information as you can. There are many programs for first-timehome buyers which might help them to get the mortgage with minimum down payments.

The Process for Buying A House

In today’s world being a homeowner is one of the most rewarding feelings that one could have. If you are a first-time new home buyer it is very important to know the process of buying a house. The first thing that an individual needs to do is find a trusted licensed realtor who has adequate knowledge and experience of real estate in the area that you are buying a house. Looking at the realtor’s profile and reviews may help to find the right one.

Once you finalize on a realtor its time to finalize a mortgage lender or a mortgage broker who will provide you with a pre-approval letter. Once you receive the pre-approval you can make an offer to the property that you liked and finally sign the sales contract. The financial institute like a broker or a lender will help you secure the mortgage loan that is required to buy your new home. Once you secure the mortgage loan through the lender or a broker, they will underwrite your loan and get it approved based on your documentation and federal guidelines. Once you receive a final approval you are good to close the mortgage loan on your new home.

Benefits of Buying a House

When you arebuying a house you would always have some share in your home as equity. As a new home buyer, you could also take advantage of a few home-related tax benefits. Once you get a home mortgage you can always get a tax write-off for the mortgage loan that you took for the new home. If you paid points when you got the original mortgage loan you can always get it written-off while you are filing your taxes.

Another advantage of having your own home is you have fixed costs compared to renting, as the landlord might hike your rent without prior intimation. By buying a house with a fixed-rate mortgage, you can actually count on more predictable costs related to your housing expenses. Although some aspects of your homeownership will fluctuate like property taxes, your monthly mortgage payments would largely remain the same. Another benefit of being a homeowner is that you have complete control of the home that you bought. You can customize your home according to your comfort.

Options for Buying A House

When you plan to buy a new home for the first time like most people you might be also trying to figure out about down payment andmortgage loan programs that are currently offered. If you are a first time new home buyer you might want to understand which category you relate to. There are a few first time home buyer loans that you can choose from. Some of the first time home buyer loans can help you finance up to 100% of the property value. Although 100% financing sounds great, you might have to qualify for these loans.

For the individuals who have credit challenges and with limited cash for down payment FHA loans could be the best option. The advantage of the FHA loan program is that it allows a borrower to make a very low down payment of the purchase price. For potential first time home buyers who have good credit but limited cash for a down payment, there are conventional first time new home buyers loans like ‘home possible’and‘home ready’ which gives borrowers an option to make down payment as low as 5%. Whether it be an FHA loan, conventional mortgage loan, or first time new home buyer loan we have lenders who can get the right program that suits you the best.

Why Buy a House With Compare Closing?

Whether you are a first-time new homebuyer or a real estate investor, buying a house could be a process with a lot of anxiety and might require immense patience and time. We at Compare Closing LLC are here to assist you in every step of the process to make it as smooth and as hassle-free as possible. With us comes the experience of mortgage lenders and brokers who have helped many individuals not only to guide them in the process but also to make their new home buying experience a pleasant one. With a minimum down payment, lesser documents, our preferred lenders can help you close on your new home purchase within 8 to 15 working days.Buying a house is a big decision for anyone. Compare Closing has your back. We can get you pre-approved for a mortgage in minutes and get your new home mortgage closed in no time.

Related Blog

What Is A Secured Loan? – The 4 Most Common Types

Many individuals require financial aid at some point in life depending on the situation. There are many loan options available for borrowers in the market. These loans are further bifurcated into two categories, secured loans, and unsecured loans. In this post, we will understand what are secured loans and what is the difference between a secured loan and vs unsecured loan.

The Significant Guide To Deed Of Reconveyance One Must Know

When you take out a mortgage to buy a house through a bank or a lender, the bank or the lender owns the property till the mortgage is paid in full. However, what happens if you pay off the mortgage? In this post, we will understand what is a reconveyance deed in detail.

What Is A Purchase Money Mortgage? – The 3 Important Types

What happens when you are unable to qualify for a traditional mortgage while buying a new home due to poor credit or high debt to income? In this post, we will understand what is a purchase money mortgage in detail.

What Is PITI In Real Estate? – The Comprehensive Guide

If you are buying a property or refinancing a current mortgage, you might have come across a term called PITI. In this post, we will understand what is PITI in a mortgage in detail.

What Is Leasehold Estate – Is This The Best Option For You?

Most people are aware of the difference between owning a home and renting one. However, there is a third category that not many people are aware of which is known as a leasehold estate. In this post, we will learn what is a leasehold property in detail.

The Ultimate Guide To Housing Expense Ratio One Must Know

When individuals are planning to buy a new home with the help of a mortgage, many get confused on what is the home value that they can afford and how much is the loan amount that they can qualify for. In this post, we will learn what is housing ratio is and how to calculate it.

What Is Eminent Domain And How Does It Work? – The Complete Overview

You put a lot of effort and energy to buy a house like going through a long process of putting an offer, acquiring a mortgage, and signing tons of documents. In this post, we will understand what is eminent domain, and what is condemnation.

Real Estate Acquisition Cost – The Expert Guide One Should Know

When you are buying a real estate property, you incur a lot of costs in the transaction. Whether it be an individual or a corporation, it is important for you to know the acquisition cost incurred to complete the real estate purchase. In this post, we will learn what is an acquisition cost in detail.

What is a Buyer Broker Agreement? – The Absolute Guide

If you are looking to buy a new home your first step is to find a realtor that is going to represent you as a buyer’s realtor for the entire home buying transaction.In this post, we will learn what is buyer broker agreement is in detail.

What Is Construction Mortgage? – How Can One Get It and 4 Different Types

When you are looking for a property there are two options you have, either you can buy a ready-to-move home, or buy land and build your own home. In this post, we will understand about construction mortgage or a construction loan in detail.

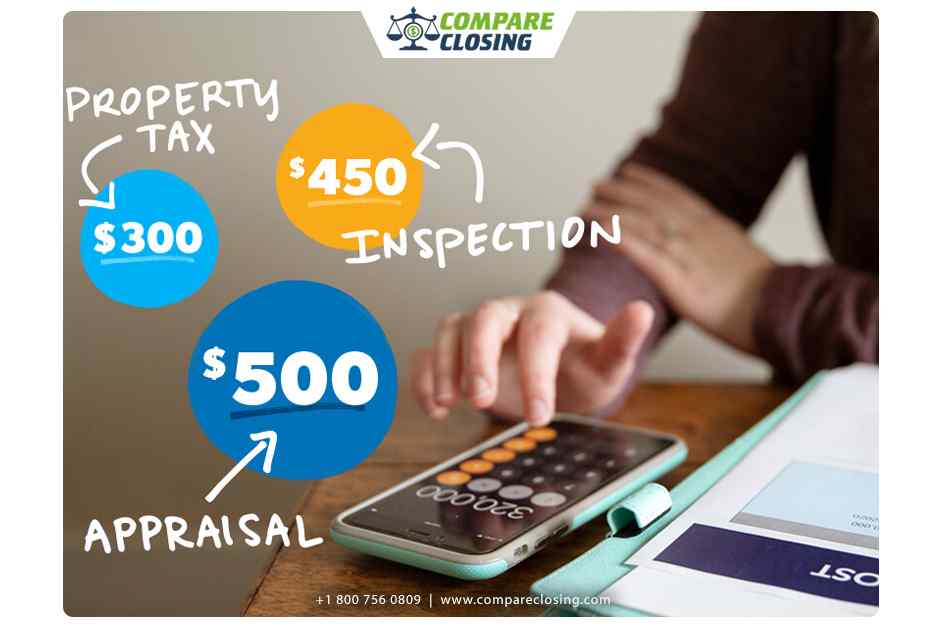

What is Home Appraisal Fee? – The Best Tip to Avoid Paying It

When you are buying or selling your house, how do you know the exact value of your home? There are online sites where you can get an idea about what the property could be worth (AVM). In this post, we will understand what the home appraisal fee is in detail.

About Mortgage Application Fees – Top Guide One Should Know

A potential borrower is charged a loan application fee for processing and underwriting a loan application for example a home or a vehicle loan. Many observers, however, believe that they are superfluous or pricey.

What is a Certificate of Reasonable Value (CRV) in a VA Loan?

If you are a veteran or active service member who is looking to buy a home, a VA loan is the best bet for you. To get a VA loan approved you might need some additional documents that are required according to VA loan guidelines.

What is an Aggregate Adjustment and How It is Calculated?

If you are looking to get a mortgage for a new property, you have to apply for a mortgage with a lender. Once you apply your lender is supposed to provide you with a loan estimate within three days from the day of your application.

What is a Certificate of Occupancy? – The Comprehensive Guide

When you are buying a property or making some major changes in the property you might come across a term called the certificate of occupancy. But what is a certificate of occupancy? In this post, we will learn what is a certificate of occupancy in detail.

What Is The VA Certificate of Eligibility?: A Complete Overview

If you are an active military service member or a veteran who is looking to buy a new home, a VA loan is just the best bet for you. However, in order for you to qualify for a VA loan, you need to first have a VA certificate of eligibility (COE). In this post, we will understand what is VA certificate of eligibility is and how it works.

The Balloon Loans – Expert Guide With Its Pros And Cons

When you are looking for options to refinance your mortgage or buy a new home, you may encounter different types of mortgage programs. In this post, we will know more about one such mortgage program called Balloon loan mortgage.

The 2 Types of Title Insurance For Homebuyers: Expert Guide

When you are buying a new home, you would come across the term called Title insurance with a cost associated with it. The term Title refers to a person or entity’s ownership of property. Title insurance is basically as the name implies, insurance for the property’s title.

What is a USDA Loan? – Comprehensive Guide for Homebuyers

When you are looking to buy a new home there are a lot of things that are going through the buyer’s mind. One of which is which loan program is the best suited for the property that you are looking to buy a home.

The Best Guide To Mortgage Escrow Process For Home Buyers

A new home purchase can be an intimidating process, as most of the borrowers may not be ready for it. One of the most confusing processes could be the escrow process also known as closing. The escrow process starts when the seller accepts your offer to buy his house, and continues till you as a buyer receive the key to the house.

All About Fannie Mae – The Complete Guide One Should Know

The Federal National Mortgage Association (FNMA) lovingly known as Fannie Mae, is a government-sponsored enterprise (GSE) that was created by Congress to encourage homeownership and provide liquidity to the mortgage market.

All About Recording Fees And Who is Suppose To Pay It?

There are quite a few costs involved that are a requirement as part of the loan closing process. Recording fees might be one thing that you didn’t anticipate finding among your different closing costs.So, Let’s look at what is a recording fee during a home buying process.

W2 Form – Who Needs To File And How One Should Read It?

At the end of every year, the documents which an employer is supposed to send the W-2 Form to each employee and the Internal Revenue Service (IRS), this W2 form is also recognized as the Wage and Tax Statement.

What Is Small Business Administration (SBA)? – The Top Guide

Established in 1953, the Small Business Administration (SBA) is an autonomous U.S. government agency that provides assistance to small businesses it was formed with an intent to support and promote the economy in general.

The Top Guide To Guaranteed Loans – 3 Different Types Of It

When a loan is guaranteed by a third party or when they assume the debt obligation in the event that the borrower defaults it is called a guaranteed loan. A government agency guarantees a guaranteed loan by purchasing the debt from the lending financial institution and taking the responsibility for the loan.

What Is A PIW Mortgage – The Absolute Guide One Should Know

A mortgage that qualifies for an appraisal waiver, meaning when a loan can be approved without a full home appraisal report it is called a property inspection waiver (PIW) mortgage.

A Guide To Residential Mortgage And 5 Different Types Of It

A loan that people get in order to buy a house or other residential property in which they will live is called a residential mortgage. The loan is fixed by a lien on the property and the borrower repays it over a specified period of time.

Top Guide About Paycheck Protection Program One Must Know

Paycheck Protection Program initially was a $350-billion program built with the intention of providing American small businesses with eight weeks of monetary assistance through 100 % federally guaranteed loans. The PPP loans are supported by the Small Business Administration (SBA).

What Is A Contingency Plan? And The 4 Different Types Of It

The word contingency is very common and is being used in our day-to-day lingo, but when it comes to the financial industry let us look at what exactly does it mean?. Many businesses took a hit due to the coronavirus pandemic in 2020 forcing many employees to work remotely.

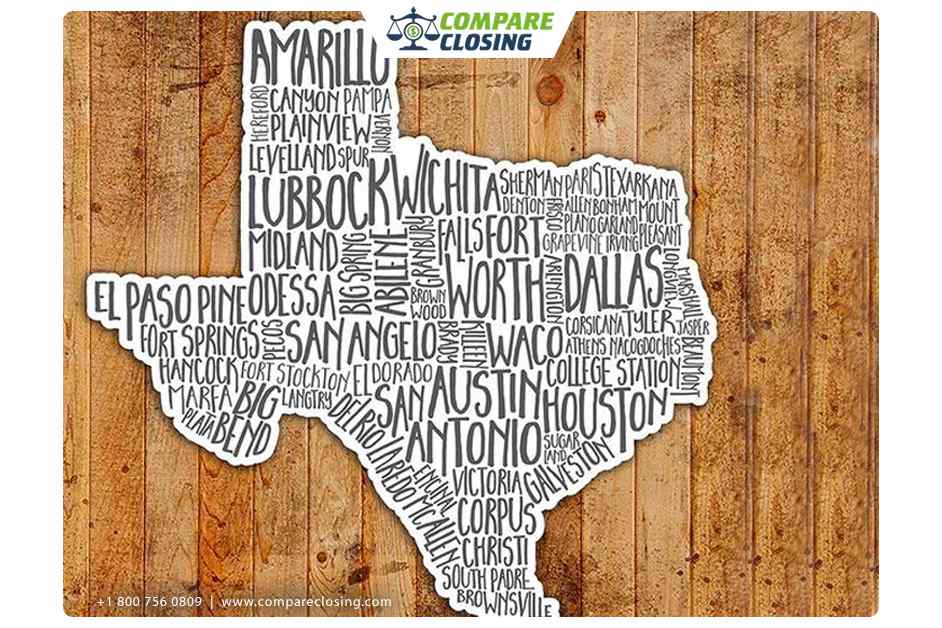

My First Texas Home Program – Unlock The 5 Different Types

According to Texas A&M University’s Real Estate Research Center, a huge wave of demand has fueled the housing market in Texas, at the start of 2021, the homes were selling in a record 43 days’ time.

5 Important Steps Guide for Buying A Home For First Time In Texas

Buying a home for the first time comes with lots of dedication and requires immense time and patience. Shopping around for a house could be a tiring task.But when you have a clear mind and intention, it could be less of a hassle. Let’s discuss 5 steps to check before buying a home for the first time in Texas.

9 Important Documents for First Time Home Buyer In Texas

While closing on your dream home as a first-time home buyer in Texas, you might have signed many documents. Let us know what documents to keep for the first-time home buyer and where can you get those documents if you have accidentally misplaced them.

15 Important Property Inspection Checklist For Homebu

Although architectural particulars, wall and floor coverings, modern amenities, and many other factors are important in the buying decision, the focus of this property inspection checklist is on the structural/mechanical/electrical state of the property.

5 Steps Guide For Buying A Home In Texas – Complete Overview

In today’s world, being a homeowner is one of the most rewarding feelings that one could have. If you are a first-time or investment buyer, it is imperative to know the process of purchasing a property. Today we will discuss five essential steps that you need to remember while buying a home in Texas.

5 Steps Guide For Buying A Home In Texas – Complete Overview

In today’s world, being a homeowner is one of the most rewarding feelings that one could have. If you are a first-time or investment buyer, it is imperative to know the process of purchasing a property. Today we will discuss five essential steps that you need to remember while buying a home in Texas.

What Is The LIHTC Programs – Low Income Housing Tax Credit

A tax incentive that is designed for housing developers to construct, purchase, or renovate housing for low-income individuals and families is called the Low-Income Housing Tax Credit (LIHTC). The LIHTC was written into the Tax Reform Act of 1986.

What is an Appraisal Contingency? – Best Guide for Homebuyers

If a home is appraised for less than the purchase price included in the contract then there is a provision that is included in the purchase contract allowing homebuyers to back out of their contract this is termed as an appraisal contingency clause.

What is a Loan Shark? – Unlock The Shocking Truth About It

A loan shark loans often are members of organized crime groups who loan money at very high-interest rates and usually uses threats of violence to collect back the debts. The interest rates are much above the established legal rate.

What Is Purchase Money Mortgage? – Best Tips for Homeowners

A mortgage provided to the borrower by the seller of a home in the course of the purchase transaction is termed as a purchase money mortgage. It is also called seller or owner financing, in situations when the buyer cannot qualify for a mortgage through traditional lending channels this purchase-money mortgage is done.

What is Unrecaptured Section 1250 Gain – The Expert Opinion

An Internal Revenue Service (IRS) tax provision recaptures the previously recognized depreciation into income when a gain is realized on the sale of depreciable real estate property this is called unrecaptured section 1250 gain. As of 2019, the unrecaptured section 1250 gains are taxed with a higher limit of 25% tax rate, or less in some cases.

What Is Bridge Loan?: Discover Popular Types with Pros and Cons

A loan taken against a homebuyer’s current home for making the down payment on their new home is a bridge loan. If you want to purchase a new home before your current home has sold then a bridge loan may be an ideal option for you.

What is a PIW Mortgage – The Absolute Guide One Should Know

When a mortgage is eligible for an appraisal waiver, meaning, the loan can be approved without a full home appraisal report then it is called a property inspection waiver (PIW). With a property inspection waiver, you pace up the loan process and save almost $300 or $400 which is a usual cost for a full home appraisal report.

All About Real Estate Attorney – Do You Need One And When?

Buying a home is probably the biggest financial decision anyone ever makes. While hiring a Realtor to help you negotiate a transaction, you might want to consider hiring a real estate lawyer so they can assist you to wade through the legal procedures.

What Is Property Inspection? 6 Different Types One Should Know

A non-invasive, visual inspection of a property, that is carried out by a fully qualified professional is called a Property Inspection. These property inspectors evaluate buildings and their components.

A Guide About Commercial Real Estate Loans One Should Know

Income-producing property that is exclusively used for business instead of residential purposes is known as Commercial real estate (CRE). In short commercial real estate loans are mortgages secured by liens on the commercial property.

The Home Mortgage Disclosure Act (HMDA) – An Amazing Guide

The Home Mortgage Disclosure Act (HMDA) is a federal law which got approved in 1975. The Federal Reserve through Regulation C implemented it. In 2011, the Consumer Financial Protection Bureau (CFPB) got the rule-writing authority of Regulation C.

What Is Fair Market Value (FMV) And Where Is It Used?

When put in simple terms, fair market value (FMV) is the price that an asset would sell for in the open market. Mainly in tax law and the real estate market, this term is used.

What Is a Conventional Mortgage Loan? – Tips To Qualify

Many homeowners opt for a conventional mortgage loan, which is a great choice because they offer lower costs compared to other popular loan types. A conventional mortgage is a mortgage that is not guaranteed or insured by the federal government.

Mortgage Credit Certificate – Its Working, Process & How To Qualify

A mortgage lender gives a document to the borrower which converts a portion of the mortgage interest paid by the borrower into a non-refundable tax credit this document is known as a mortgage credit certificate or MCC. Either loan brokers or the lenders themselves can issue, mortgage credit certificates but they are not a loan product.

Chattel Mortgage and Types: A Complete Guide One Should Know

If a borrower is looking to purchase a movable piece of equipment or modular home, then a chattel mortgage could turn out to be a good option. When a borrower wants to purchase a home that isn’t permanently attached to the land then this type of loan is often used.

The No Down Payment Mortgage – What is It And How to Get One?

Have you been worried and wondering that in order to get a mortgage how much would you need to save? But the truth is it’s possible to buy a home with no down payment! Let us look at few options with which you can buy a home with no down payment mortgage.

What Is A Homeready Mortgage And What Are Its Benefits?

When thinking of homeownership the most important decision is finding the right mortgage to finance our home. Many Americans are unable to put down the standard 20% down payment so the Federal National Mortgage association came up with options.

All About Manufactured Home and Excellent Tips For Buying It

While More and more Millennials are struggling with their student loans and Boomers are looking for ways to cut down on their expenses, manufactured homes have captured the imaginations of the newer sect of Americans.

All About Asset-backed Securities (ABS) And 5 Types of it

A type of financial investment that is guaranteed by an underlying pool of assets, especially those, which generate a cash flow from debt, like loans, leases, credit card balances, or receivables is termed as asset-backed security (ABS).

What Is Collateralized Debt Obligation (CDO)? – Best Explanation

A fusion of structured finance products that are backed by a pool of loans and other assets and sold to institutional investors is called a collateralized debt obligation (CDO). A CDO’s value is derived from another underlying asset.

What Is Collateralized Debt Obligation (CDO)? – Best Explanation

A fusion of structured finance products that are backed by a pool of loans and other assets and sold to institutional investors is called a collateralized debt obligation (CDO). A CDO’s value is derived from another underlying asset.

What Is Contingency Clauses In Real Estate? – Supreme Guide

The condition or action which must be met for a real estate contract to become binding is termed contingency clauses. When both parties, the buyer and the seller, agree to the terms and sign the contract then the contingency becomes part of a binding sales contract.

Everything About HOA Fees You Need To Know – The Best Guide

A body within a community that sets the rules for properties in its dominion and imposes them is called a homeowners association or HOA. A board consisting of property owners who are elected by other property owners in the community are the people who usually run the HOA.

How to Buy Second Home Using Home Equity to Make Down Pay

If you have a favorite vacation destination that you often visit it might make sense for you to buy a second home (vacation home). if you have enough equity in your home and use it to buy a second home.

Working of Additional Living Expenses & How One Can Get Benefit

Additional Living Expenses (ALE) coverage stops you from being in the position of being “on the streets“ or ending up at your in-laws or friends’ houses while your own house is under repair if you have a home, condo, or renter insurance.

How to Buy Second Home Using Home Equity to Make Down Pay

If you have a favorite vacation destination that you often visit it might make sense for you to buy a second home (vacation home). However, buying a vacation home is not at all the same as booking a hotel room on each trip.

Working of Additional Living Expenses & How One Can Get Benefit

Additional Living Expenses (ALE) coverage stops you from being in the position of being “on the streets“ or ending up at your in-laws or friends’ houses while your own house is under repair if you have a home, condo, or renter insurance.

Guide to Homeowners’ Insurance and 3 Differ Types of Coverage

Homeowners’ insurance may not be an exciting subject to talk or read about, but it is important to understand the about it as much as possible for new homebuyers. Practically all lenders require insurance coverage in order to protect their investment.

The Absolute Guide About Troubled Asset Relief Program (TARP)

The U.S. Treasury initiated, created, and rolled the Troubled Asset Relief Program (TARP), which was created to stabilize the country’s financial system, restore economic growth, and reduce foreclosures after the 2008 financial crisis.

What Is Amortization and How to Calculate it – The Best Guide

Amortization refers to the process of paying off a debt of principal and interest through regular monthly installments which are scheduled and predetermined is called amortization. In almost every area the payments are made in the form of principal and interest if the applicable term is ‘amortization’.

What Does Homeowners Insurance Not Cover: 9 Important List

Practically every mortgage company requires the borrowers to have homeowner’s insurance for the full value of the property before they can sanction a loan or fund a house transaction. A homeowner’s insurance is what protects you and your home in case of any damage or theft.

Working of HomePath Ready Buyer Program and It’s Advantages

As it is the dream of every American to own a home not many have attained it. With the high-interest rates, strict mortgage qualifications high rents, student loan debt, and overheated real estate markets even those with well-paid salaries find it difficult to save for a down payment and closing costs.

5 Incredible Guide About Mortgage Insurance Premium in Texas

When homeowners take out loans backed by the Federal Housing Administration (FHA) then they need to pay mortgage insurance premium (MIP). Along with allowable mortgage interest, mortgage insurance premiums were deductible until the 2017 Tax Cut and Jobs Act.

Mortgage Recording Fees – Best Way To Know More About it in Texas

The process of buying a property or home can be the biggest financial decision you ever take in your life. Thus, you would always want to know about every little thing related to the process, as much as possible.

The 15 Different Types Of Home Inspections For Buyers

If there are major structural, mechanical, or safety defects in the house you are going to buy then an inspection will allow you to cancel the contract. As part of their purchase contract, many homebuyers request a home inspection.

What are Mortgage Assistance Programs in Texas

A mortgage, for a lot of people, is by far the biggest financial decision that they will ever make. Buying a home is an emotional process and owning one is a huge source of happiness and pride but is also a big responsibility.

Tips to Understand Mortgage Contract

A mortgage is the type of loan you are most likely going to need when thinking of buying a new home unless you can pay for the house yourself. The mortgage covers the part of the purchase price (of the property) that you did not pay.

Cash to Close: What You Need to Know

Even if this term does not directly refer to actual cash, yet cash to close is important because it refers to the out-of-pocket costs you’ll need to pay prior to receiving the keys to your new home.Today we will try to know more about what exactly cash to close is and what you can expect when figuring out the upfront costs associated with buying a home.

Cash to Close: What You Need to Know

As you approach the final step of the home buying process, cash to close is the one term you want to be familiar with. Today we will try to know more about what exactly cash to close is and what you can expect when figuring out the upfront costs associated with buying a home.

Energy Efficient Mortgage Program Guide

Whether you are buying a new home, making improvements to an existing home or refinancing an old one, or only wanting to know more about Energy Efficient Mortgages.

What is a Mortgage Note? – The Brief Explanation

When buying a new home, you will come across so many mortgage terms, it can feel like you’re learning a whole new language. Pre-approvals, appraisals, and many other terms for a first-time homebuyer can be a little bewildering.

What Is A Balloon Mortgage – The Pros And Cons

Let us learn all about balloon mortgages, why to get them, the advantages and disadvantages of a balloon mortgage, and the things one should pay attention to before you make a decision.A balloon mortgage is a short-term mortgage usually for 5 to 7 years, but sometimes for as short as 2 years also.

What is Texas Homes for Heroes Program

Today in this article let us understand all about Texas Homes for Heroes Program. The Heroes of our nation like the firefighters, healthcare workers, law enforcement, military (current and veterans), EMS, and teachers have one job and that is to help others.

Texas First Time Home Buyers Benefits 2020

If you looking for a home and wanting to know more about First time home benefits, it’s a good idea to consider both federal and state programs when you conduct your mortgage search.

The Guide to Buying a House With Bad Credit

A bad credit score is anything below 670. More specifically a score between 580 and 669 is considered fair and one between 300 to 579 is poor.The very important point to note here is, it is a myth that you can’t get along with buying a house with bad credit.

FHA Loan Requirements & Guidelines for 2020

When it comes to home buying, FHA loans are one of the most common loan programs used across the country, especially for first-time homebuyers. In this post, we will understand the FHA loan requirements and FHA guidelines for 2020.

What Is An Assumable Mortgage – The Complete Guide

American homebuyers have enjoyed many decades of declining mortgage rates. Falling from the early 1980s high exceeding 18% to a low of nearly 3% in 2020. In this post, we will learn about the assumable mortgage, how does it work?

How To Get Pre-approved For A Mortgage

In this post, we will be talking about how to get pre-approved for a mortgage. The most common question asked by the homebuyers, especially first-time homebuyers is how to get pre-approved? Let us know the measures you can take to get pre-approved for a mortgage.

First-Time Home Buyers Tips for Buying a House

In this post, we will be talking to first-time home buyers or those who haven’t been in the home buying process in some time. Without further adieu, let us jump right into the first-time home buyers tips.

What are Closing Costs for Seller

What is it going to cost to sell your home? Well if you are planning to sell your home you might as well know if there are any costs involved so that you are prepared for them. In this post, we will understand what are closing costs for sellers and know more about them.

How Much Down Payment Do I Need for a House?

One of the most common questions people ask when they are buying a new home especially if they are doing it for the first time is how much they would need to buy a new home. In this post, we will know how much down payment do you need to buy a new home and the different down payment options that you have.

How to Get Mortgage with No Down Payment

Before you get a mortgage with no down payment, it is critical to make sure you have a good loan officer. Because a loan officer who knows what they are doing can make or break the whole process. In this post, we will learn how to get a mortgage with no down payment.

What Is A Co-Signer On Mortgage And How Does It Work

Most people have a fair idea of how co-signing works when it comes to credit cards or car loans but for buying a home people think it is a lot more complicated because we are talking about hundreds of thousands of dollars worth of loan instead of a credit card.

Should You Buy Real Estate in 2020

There are many speculations when it comes to buying real estate in 2020. A lot of factors have different results for different people. In this post, we will know when and why is it a good idea to buy real estate no matter what time.

What is a Seller Concession and How Does It Work

Seller concession is one of the most significant parts of a real estate transaction.If you are a buyer or a buyer’s agent, these are the fundamental skills you should have. In this post, we will learn what is a seller concession and how does it work.

How To Determine The Best Deal When Mortgage Pre-Approval Shopping

When you are planning to buy a new house, most of us tend to shop around for the best possible options out there. However, how would you compare different loans?In today’s post, we will learn how to determine the best deal when shopping for a mortgage pre-approval.

New FHA Condo Approval Guidelines That Can Help Buyers

If you are looking to buy a condo within FHA approved condos, the new FHA rules might help you especially if you are a first-time homebuyer. In this post, we will learn new FHA condo approval guidelines and how they can help borrowers.

Important Home Buying Changes During Social Distancing and Quarantine

In the current world, we are living in between social distancing and quarantine, there have been some changes to the home buying process. While there are still a lot of transactions going on, there have been also some adjustments that have needed to be made.

9 Tips For Buying A Property During Coronavirus Pandemic

As we all are facing challenges in our day to day life due to Coronavirus, the real estate market is also confronting with its own difficulties. However, there are some realtors and companies which are trying their level best to adjust to the new normal.

How to Determine Mortgage Prequalification By Yourself

In this post, we will learn how to determine mortgage prequalification by yourself and what is the calculation behind it.Everyone knows who to talk to if they are looking to buy a home.

6 Things To Avoid Saying While Buying A Property In Texas

When you are buying a new property, you would always feel that your deal should be as smooth as possible. When you find your dream house, you might get excited and say things that could put your home deal in question.

Should You Purchase or Refinance at this time In Texas?

There have been so many changes in the mortgage interest rates, guidelines in the last few days due to the recent pandemic. These are confusing times for the homeowners and new home buyers, making it difficult to decide whether or not to purchase or refinance in Texas.

Know More About 3% Conventional Loan Down Payment Program

Most of the homebuyers assume that they need to put twenty percent conventional loan down payment to buy a home. And when we talk about a 3% down payment people think that it is going to be an FHA loan.

Pros & Cons of Buying Mobile Homes In Texas

According to a survey, approximately twenty million Americans are living in mobile homes. If you are thinking about buying a mobile home for the first time, you might want to know the pros and cons of buying mobile home in Texas.

If you are getting ready to buy a home right now, it is essential for you to know what a Homeowners Association (HOA) is? and if the home that you are looking to buy is in The one? You have probably heard some good and some bad stories about HOA in Texas. In this post, we will learn what an HOA is?

FHA Loan Requirements in Texas and How to Qualify

If you are looking to buy a new home and have decided to go with an FHA loan as an option for you, this post is for you. In today’s post, we will discuss FHA loan requirements in Texas.FHA loans are fantastic loans. They are loan programs created by the government some years ago

How To Get A Mortgage Pre-Approval For Buying A Home In Texas

When you are looking to buy a new house, a mortgage pre-approval is the first thing that you got to have, so that you can know what you are equipped with.You might be in a position to buy a real estate based on your credit situation or you might not.

Pros & Cons of Buying New Construction Homes In Texas

When there are fewer homes on the market, you might have to look into buying new construction homes. In this post, we will discuss the pros and cons of buying new construction homes in Texas.

Why would anyone like to move to the state of Texas? In this post, we would discuss some of the best cities to live in Texas and a few suburbs as well and highlight a few reasons why you may want to move to Texas.

5 Questions to Ask A Realtor While Interviewing

When you are selling the house, it is prevalent to have realtors coming to your home, and your interview maybe two or three of them. One might feel the need to do it because you are going to pay them a commission to sell your house.

Do You Need a Buyer’s Agent to Buy a House?

One of the most common questions which bother a lot of buyers is “Do you need a buyer’s agent to buy a house?”. In today’s post, we will discuss if you need a buyer’s agent to purchase your home.

How To Avoid Overpaying When Buying A Home in Texas

If you are looking for buying a home or maybe you are going to start looking for one soon and find a home you actually like and it is time to make an offer, you might need some consideration. Whether you are a first-time homebuyer or a real estate investor the number one concern is that you don’t land up overpaying for your home.

4 Major Types of Down Payment Assistance Program In Texas

Low-income homebuyers all across America may qualify for thousands of dollars in down payment assistance program. You probably already know this, but housing may be expensive. In many areas, a mortgage payment may be cheaper than rent.

Things To Consider Before Closing On A House In Texas

The mortgage closing process is really very exciting. If the seller just accepted the offer you made on your home, and you guys have agreed to work together, then let us understand what you can expect and the things you should know while moving forward and closing on a house in Texas.

Buying Fixer-Uppers Vs Buying Move-in Ready Homes!

Sometimes when you get out there and start thinking about home shopping, you get a little sticker shock when you see how much these homes cost, whether it is new construction or a resale home.You wonder what happened to these more affordable homes, where are the fixer-uppers in the market?

Challenges and Tips For New Home Buyers In Texas

If you are a first time home buyer and you are on that fence, it makes a lot of sense. Sometimes you get a lot of anxiety and concerns.Yes, it could be less confusing and easy if you know how to go about it. Today we will discuss the challenges and tips for new home buyers in Texas.

10 Important Home Inspection Checklist In Texas For New Home Buyers

If you are looking to buy a new home, then you definitely need to know everything about the house you want to buy. The interiors, the paint, the heating system, the roof, the air condition, etc.

Steps to Check Before Buying a Home For The First Time In Texas

Buying a home for the first time comes with lots of dedication and requires immense time and patience. Shopping around for a house could be a tiring task.But when you have a clear mind and intention, it could be less of a hassle.

List of Documents for First Time Home Buyer In Texas

While closing on your dream home as a first time home buyer in Texas, you might have signed many documents.What were those documents? The title company gave you a copy of documents on your

Renting Vs Buying A Home In Texas: The Pros and Cons

Buying your own house is one of the most important decisions you can make to start acquiring assets and build equity. However, a lot of people get intimidated when they hear stories about losing money if they purchase a new house.

5 Steps Guide For Buying A Home In Texas

In today’s world, being a homeowner is one of the most rewarding feelings that one could have. If you are a first-time or an investment buyer, it is imperative to know the process of purchasing a property.

5 Questions to Ask A Realtor While Interviewing

One might feel the need to do it because you are going to pay them a commission to sell your house. But when we are buying a home, we tend to go with the first realtor that we meet.