What Is A Capital Stack In Real Estate And 4 Different Layers?

- Home

- Resource

- Home Equity Loan

HOME EQUITY

A home equity loan is a loan that is available for the homeowners against their equity share in their home. But why would you want a home equity loan and what exactly is it? The why part is easy, when you are thinking about a major expense such as remodeling your kitchen or looking to consolidate your bills, a home equity loan would help you achieve these goals. But what is home equity?

What is Your Home Equity?

Let us say that you bought your home for $200,000 taking a mortgage of $160,000 with a down payment of $40,000. The down payment that you made of $40,000 when you bought the house is your home equity. Let’s say, you have been making your mortgage payments for five years and you have knocked your mortgage balance down to $100,000, on top of that your home may also have changed in value, let’s say $300,000 is the current property value. So take the current value of $300,000 and subtract the money you still owe on the mortgage which is $100,000 and you will get your home equity which is $300,000 - $100,000 = $200,000. A home equity loan allows you to borrow against that value.

Types of Home Equity Loans

Just like your mortgage a home equity loan is also called a secured debt as it is given against your property because of which you get better interest rates and higher borrowing amounts compared to unsecured loans. There are three types of home equity products.

1) Home Equity Line Of Credit (HELOC): A HELOC functions more like a credit card with an approved borrowing limit which you can access as you need over time. The interest rates on a HELOC is a variable that can move up and down based on market fluctuation. Since your payment is determined by how much you borrowed and your current interest rate your payment varies as you change the amount you borrow or as the interest varies.

2) Home Equity Loan or Second Mortgage: Home Equity Loan usually offers a fixed amount for a fixed time with a fixed rate of interest and predictable regular monthly payments. It works similar to your primary mortgage but could be with a different lender for what it matters. Since the interest rates are fixed you would be getting a lower interest rate compared to HELOC. HELOC acts as a second lien on your property and hence is also called a second mortgage.

3) Cashout-Refinance: A Cashout-refinance is a transaction where the borrower gets a loan against the home equity accumulated over the years, combines it with the current primary mortgage, and make one single payment. For example, you have a mortgage balance of a hundred thousand dollars and you need to borrow fifty thousand more, with cashout refinance your new loan amount would be one hundred and fifty thousand dollars and you would make one single payment towards your new loan.

Best Use Of Home Equity Loan.

You can use a Home equity loan for any reason, however, the most common uses for using the home equity loans are as follows:

1) Major Expenses: A home equity loan typically offers a better interest rate than any other unsecured loans. So paying for large expenses such as weddings, college, or any medical emergency with home equity loan may be a good way to handle your finances.

2) Home Improvements: This is one of the most common uses of home equity loans. Using loan proceeds to pay for home improvement projects such as renovating your kitchen, adding a bedroom, or upgrading your roof, can be a great way to increase the value of your home. In some cases, the interest that you pay may also be tax-deductible.

3) Debts Consolidation: Home equity loans offer many advantages over other types of loans. Since home equity loans are secured by your home they often offer a lower rate of interest compared to many credit cards or personal loans. Through debts consolidation you can save money on the high-interest debts.

Why Use Compare Closing For Your Home Equity Loan Requirements.

Sometimesmajor expenses can come as surprise, however, if you have enough home equity you can use it as one of the best financial tools to get through such surprises. Compare Closing LLC bring a ton of experience from best in class leaders who would not only provide you the best cashout-refinance options but would do it with optimized closing costs. If you want to pay off high-interest debts, get cash for remodeling your home, or want to pay for your kid's college, call Compare Closing LLC where we will compare from our preferred lenders and provide the best deal in the market for you.

Related Blog

The Detailed Guide To Transfer Tax And The 3 Types Of It

Purchasing a home is one of the most important and expensive transactions for any individual. There are many costs involved in a property purchase like closing costs, attorney fees, appraisal fees, title insurance, etc.

The Top Guide To Sale-Leaseback In Real Estate One Must Know

As we all know the housing market is at its peak. The homeowners are looking for multiple options to sell their homes in this market while retaining their interest in their properties. Most of these homeowners are real estate investors who make up about twenty percent of the housing sales.

What Is Reverse Annuity Mortgage & What Are Its Advantages?

Most of the senior citizens in the country have a lot of financial challenges. Though they may have little or no mortgage on their homes, they live on a fixed income with high medical expenses. In this post, we will learn about reverse annuity mortgages in detail.

A Promissory Note – The Comprehensive Guide One Must Know

Whether it is a mortgage, personal loan, car loan, or a student loan, the intention of the borrower is always to repay the amount borrowed to the lender and the lender expects the same. That is when they use promissory notes. In this post, we will learn what is a promissory note in detail.

Top Guide To Planned Unit Development (PUD) One Must Know

When you are planning to buy a new home there are many types of homes that you can choose from. However, when you are about to finalize your home and your real estate agent says that the property comes under planned unit development or PUD, you should have enough idea about it. In this post, we will understand what is a PUD in detail.

What Is Liability Insurance? – The 4 Important Types Of It

Most people are aware of homeowner’s insurance which covers your home in the event of any damages that occurred during your homeownership. In this post, we will learn what is liability insurance and how it works.

What Is Hybrid Financing And The 4 Important Types Of It?

Capital and finance play a very crucial role in any organization for its smooth operation. There are many financial products available for companies to run a successful business. In this post, we will understand what is hybrid financing in detail.

What Is An Encumbrance In Real Estate And 5 Different Types Of It?

When you purchase a real estate property, by law you become the rightful owner of the property and your name is registered on the title. In this post, we will learn what is an encumbrance in real estate in detail.

What Is Annuity & How Does It Work? – The 3 Important Types

There are many options to choose from when you are planning your retirement. It is important to have a retirement plan so that you don’t have to liquidate your assets when you retire. In this post, we will understand what is an annuity in detail.

What Is HOEPA and Its Regulations? – A Comprehensive Guide

When you are buying a home, refinancing a mortgage, getting a home equity loan, or a HELOC it is important to know your rights as a consumer. One such act is Home Ownership and Equity Protection Act. In this post, we will dive deep to understand what is HOEPA in detail.

What Is Property Casualty Insurance and Benefits? – A Top Guide

Insurance is basically of two types one is for people and the other is for assets. In this post, we will learn what is property-casualty insurance and how it works.Property and casualty insurance is insurance against property loss, damage, or similar liability.

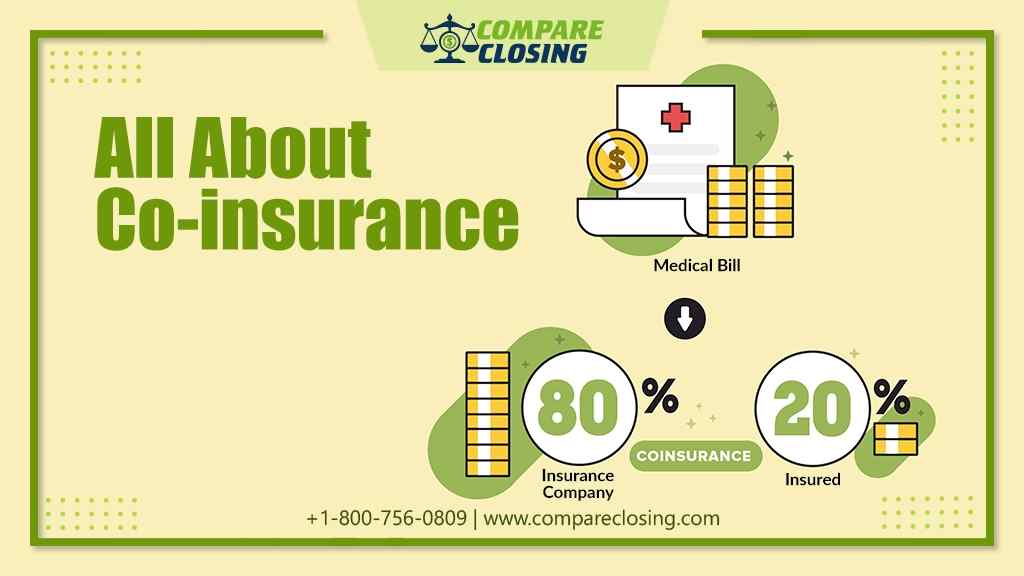

What Is A Co-Insurance And Does It Benefits Homeowners?

When you have any medical emergency, many people keep themselves prepared with health insurance. In this post, we would be learning about what is co-insurance and how is it calculated.

Important Guide About Consumer Credit And The 2 Types Of It

Every individual at some point in life requires some or other way of credit. Whether it is a home, appliances, car, or getting a credit card, an individual may need credit and financial assistance for any of these things. In this post we will understand, what is consumer credit in detail.

Equal Credit Opportunity Act (ECOA) – The Top Guide One Must know

When it comes to lending, all borrowers are equal. Whether it is a car loan, student loan, mortgage, or personal loan, all applicants have equal rights when it comes to borrowing in the marketplace. In this post, we will learn more about what is ECOA in detail.

What Is Hazard Insurance & Why Is It Important To Lenders?

When you are applying for a mortgage or refinancing your current one, there are a lot of documents that are required by the lender to process your loan. One of the most commonly asked documents by lenders is hazard insurance. In this post, we will learn what is hazard insurance in detail.

What Are Combination Loans And 2 Important Types – The Detailed Overview

While buying a new home borrower needs to make a minimum down payment of 20% to avoid private mortgage insurance. In this post, we will understand and know more about combination loans.

What Does Home Appreciation Mean and How It is Calculated?

When you purchase a home, you will always expect the home value to go up. In most cases it does. However, there might be some instances where the home values do not appreciate and could create a sense of loss if you want to sell the property now.

What Is Credit Insurance? The 3 Major Types Of It For Homeowners

Many people know about life insurance, health insurance, car insurance, and homeowner’s insurance. But not many people talk about or take advantage of what they call credit insurance.

What is a Due on Sale Clause in a Mortgage? – Unlocked the Secret

If you are talking to a mortgage lender or broker about the residential investment property that you are planning to buy and looking to get a conventional loan, they are following the Freddie Mac and Fannie Mae guidelines to underwrite these loans. The lender can accelerate and call the note due. In this post, we will understand what is due on sale clause.

Deed in Lieu of Foreclosure & Its Advantages: The Top Guide

When you buy a home or refinance your mortgage, you show full responsibility to pay the debt in full. Sometimes life takes a turn in an unexpected way due to which a borrower is unable to make the payment.

The HELOC Requirements 2022 – Absolute Guide For Homeowners

If you are planning to get some cash out of your home equity, there are many options that you can use. One of which is a home equity line of credit (HELOC). Many people have a lot of questions about HELOC like, how to qualify for a HELOC, or what are HELOC requirement.

Home Equity Loan Requirements For 2022 – The Best Guide

Your home’s equity is one of the biggest sources of money that you have. And one of the ways to access that money is through a home equity loan. Many people are not aware of the home equity loan and how they can get one. In this post, we will learn what the home equity loan requirements are.

How Does A HELOC Work – A Comprehensive Guide One Should Know

A lot of people know what home equity is and many of you might have taken advantage of your home equity for many different reasons. But for few who want to know about that is a HELOC (Home Equity Line Of Credit) and how does a HELOC work, this post is exactly what will help you understand that.

What Are Fixer Upper Houses? – The 6 Ideal Ways To Buy It

With a tight budget, homeownership is a task. Hence many house shoppers opt for a fixer-upper houses over the move-in ready homes.A fixer-upper houses has its own set of setbacks and advantages. It is ideal that home shopper familiarizes themselves with them before buying a fixer-upper that is in bad condition.

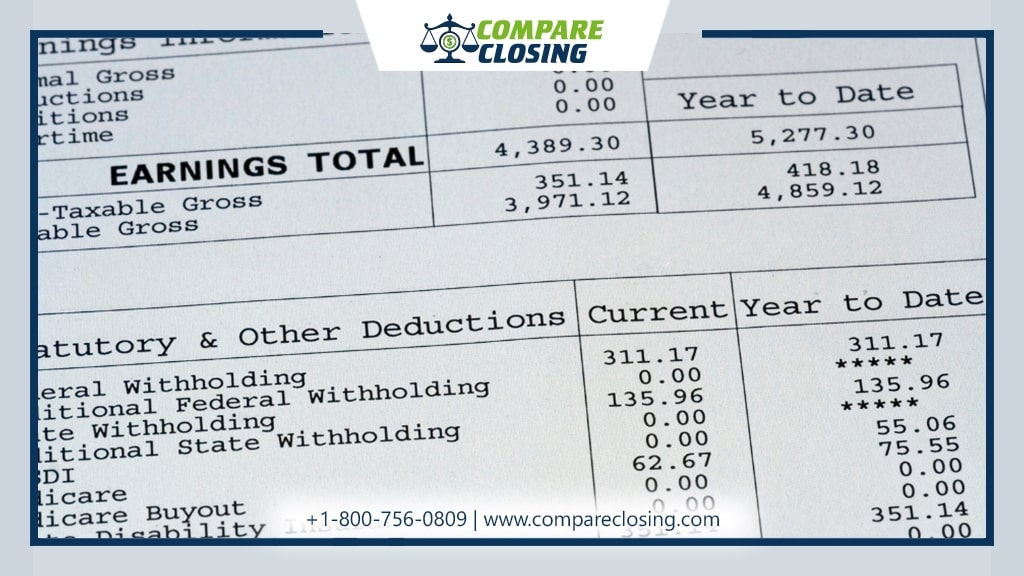

Detailed Guide About Pay Stub And What All Are Included In It?

If an employer has employees on the payroll, then on a regular basis they withhold taxes and issue payments. And regardless of which way they choose to pay their employees, there is always an item they typically need to give to employees which is a pay stub.

Home Renovation Loan: How to Improve Your House Retail Value?

Home renovation loans allow the borrower to finance home repairs and updates, which can improve their home’s retail value and aesthetic appeal. The most popular remodeling projects are kitchens and bathrooms which could cost around $20,000, many homeowners can only afford these projects through a home renovation loan also called a home improvement loan.https://www.compareclosing.com/blog/wp-content/uploads/2021/12/Home-Renovation-Loan-How-to-Improve-Your-House-Retail-Value.jpg

What Is An Appraised Value And Its Importance In Mortgage?

When a property’s value is evaluated based on a given point in time it is called an appraised value. During the mortgage origination process, a professional appraiser performs the evaluation. The lender usually chooses the appraiser but it is the borrower who pays for the appraisal.

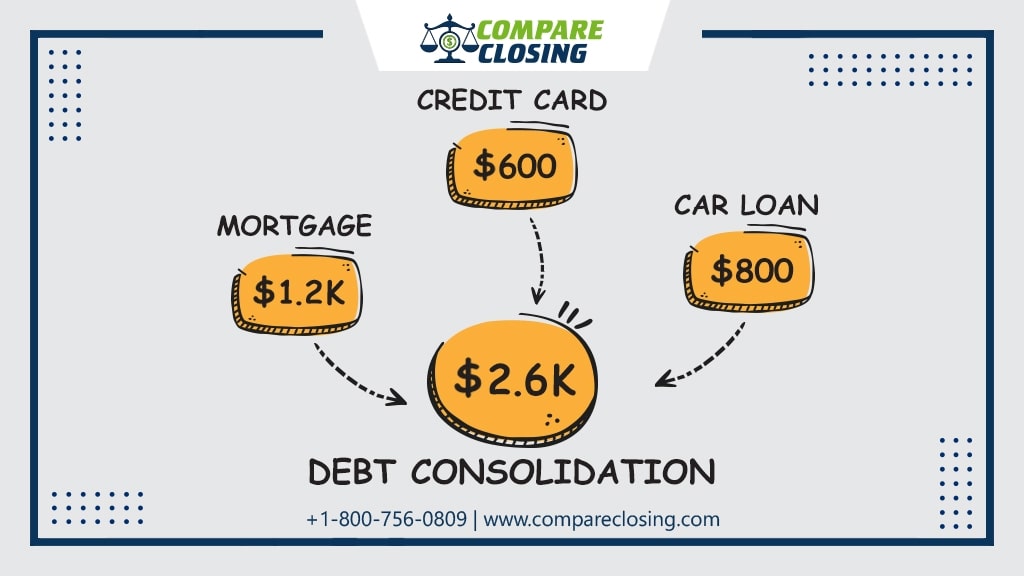

What is Debt Consolidation?: 4 Ways To Consolidate Your Debt

When a new loan is taken out to pay off other liabilities and consumer debts this act is referred to as debt consolidation. Multiple debts are fused together into a single, larger debt, like a loan, that has more favorable payoff terms in the form of a lower interest rate, lower monthly payment, or both.

What Is An Accessory Dwelling Unit (ADU)? – The Pros And Cons

A secondary house or apartment that shares the building lot of a larger primary home is called an Accessory Dwelling Unit (ADU) in legal and regulatory terms. Even though the unit cannot be bought or sold separately, they are often used to provide additional income through rent or to house a family member.

How To Calculate Home Equity And Best Tips To Build It

Today in this post we will learn how to calculate home equity and understand the list of factors involved and superior guide to build equity in your home.It is obvious that the ideal time to sell a house is when one can make a profit.

Simple IRA: The Better Way to Save for Retirement

Most small businesses with 100 or fewer employees can use a retirement savings plan that is called a SIMPLE IRA. “SIMPLE” represents “Savings Incentive Match Plan for Employees,” and “IRA” is for “Individual Retirement Account.”

What is a Designated Roth Account?: A Comprehensive Guide

A separate account in a 401(k), 403(b), or governmental 457(b) plans where the designated Roth contributions are made is called a Designated Roth Account. Designated Roth accounts are not offered by SARSEP and SIMPLE IRA plans.

4 Useful Tips To Building Home Equity in Your New Home in Texas

It’s out there. Buying a new home is one of the most intriguing processes. There is too much thought which goes in when looking to buy a new home. Below are 4 tips for building home equity and do not end up underwaters on your new home in Texas.

Cash-Out Refinance vs HELOC in Texas: Pros and Cons

Over the last couple of years, the average home value has seen a substantial increase. Due to this, many people are trying to tap into their equity for home improvement, to get a down payment for a second home, consolidating debts, etc.

5 Incredible Benefits Of A Cash-Out Refinance In Texas

Cash-out refinances could be the best possible way to cover your major expenses. If you have built enough equity in your house, you could utilize this equity for various reasons. Listed below is the expert’s advice on the benefits you could gain if you opt for a cash-out refinance in Texas.

Home Equity In Texas: Best Tips To Grow and Use It Wisely

In this post, we will understand what is home equity is and how to grow and use the equity in Texas.Home equity is one of the most common phrases used in real estate. A simple equation to understand equity is, {Home Value} – {Mortgage} = {Home Equity}.

About Home Equity Loans In Texas And How Can One Obtain

Many homeowners want to know information about their home equity and how to use it. What are the home equity loan products available for their major expenses? Let us understand two types of home equity loans in Texas, and why would you need them.

About Home Equity Loans In Texas And How Can One Obtain It

A home equity loan is a second mortgage that is borrowed against the remaining equity on your house after the first mortgage. The amount of the loan is decided on the property value and your current 1st mortgage balance.

About Tax Credit Property: Top Secret for Low-Income Populations

An apartment building or any accommodation which is owned by a developer or landlord who engages in the federal low-income housing tax credit (LIHTC) program is called a tax credit property.

The Detailed Guide About HIRO Program & How To Qualify For It

Fannie Mae’s HIRO program was created for borrowers who have not benefitted from rising home values in recent years. HIRO is meant to lend a hand to homeowners who have little or no equity to refinance for a lower interest rate and monthly payment.

The Beginners Guide to Understand 401 K Plan – Overview

A 401 K plan is named after a section of the U.S. Internal Revenue Code, it is a defined-contribution retirement account provided to employees by their employers. The investment earned in a traditional 401 K plan is not taxable till the time employee doesn’t withdraw that money.

What is CLTV Ratio in Real Estate? – Best Tips to Calculate

The ratio of all secured loans on a property to the value of a property is the combined loan-to-value (CLTV ratio). When more than one loan is used, the CLTV ratio is used by lenders to identify a prospective home buyer’s risk of default.To borrowers with high credit ratings the lenders are willing to lend at CLTV ratios of 80% and above.

What is a Keogh Plan? – Comprehensive Guide for Your Retirement

The tax-deferred pension plan for retirement purposes that is available to self-employed individuals and autonomous businesses is called the Keogh plan. A Keogh plan can be created as a defined benefit or a defined contribution plan

All About 401A Plan: Best Advice to Plan Your Retirement

A 401a plan is an employer-sponsored money-purchase retirement plan that allows dollar or percentage-based contributions from the employer, the employee, or both. The 401(a) plan is a retirement plan for employees working in government offices

What Is The Debt to Equity Ratio? Beginner Guide to Calculate It

When a company’s financial leverage is evaluated and calculated by dividing a company’s total liabilities by its shareholder equity it is called the debt-to-equity ratio. In the event of a business downturn, it reflects the ability of shareholder equity to cover all outstanding debts.

Comprehensive Guide About DSCR And How To Calculate It

Corporate, government and personal finance have the debt-service coverage ratio applicable to them. In relation to corporate finance, the debt-service coverage ratio (DSCR) is the quantification of a business’s available cash flow to pay current debt obligations.

A Comprehensive Guide About (HELOC) Home Equity Line Of Line

The ability to build equity over time is one of the biggest perks of homeownership. This equity can be used to secure low-cost funds for the second mortgage of either a one-time loan or a home equity line of credit (HELOC).

Should You Use Home Equity Loan To Payoff Credit Cards Debt

You may be struggling to bring your debt level down if you have large outstanding balances on your credit cards. If you own your home, you have the option of taking out a home equity loan to payoff credit cards debt.

The Top Guide About Home Improvement Loans One Should Know

Just by making upgrades or the right repairs to your home, you add a great deal to its resale value also its looks, comfort, and style will get enhanced. Without taking out home improvement loans not many people can afford a big property project.

What is RMD – Required Minimum Distribution?: An Amazing Guide

An RMD is the amount of money that must be withdrawn by owners and qualified retirement plan participants of retirement age from an employer-sponsored retirement plan, traditional IRA, SEP, or SIMPLE individual retirement account (IRA).

What Is the SECURE Act: The Expert Overview One Should Know

A variety of retirement account rules got changed with the SECURE Act including who is eligible to contribute to retirement accounts and when withdrawals are required. The early withdrawal penalty is also taken care of by the new legislation.

What is a 529 Plan? – The Major Types and Benefits

A tax-advantaged savings plan that is designed to help pay for education is what a 529 plan is. Originally it was only limited to post-secondary education costs and is now covering K-12 education in 2017 and apprenticeship programs in 2019.

Looking to Refinance HELOC: The 4 Amazing Tips for You

There is an initial draw period, of about 10 years when a borrower refinances home equity line of credit (HELOC). One way to solve the payment-shock problem is to refinance HELOC, and there are many ways to do it.

Top 5 Alternative To Reverse Mortgage: The Expert Opinion

Many people use the equity of their residence as a method to raise cash. A homeowner may use several methods to tap into this process income, but some of them are better than others. The most popular option is the reverse mortgage, though it may not be the best choice for many homeowners.

Home Equity loan Calculation: Best Way To Calculate Your Equity

Most people usually, know what their home equity is. But if are not too clear. Today in this topic we will guide you to understand how home equity works and home equity loan calculations. Home equity is especially required if you are looking to refinance a mortgage or borrow money against your home.

Simple IRA: The Better Way to Save for Retirement

Most small businesses with 100 or fewer employees can use a retirement savings plan that is called a SIMPLE IRA. “SIMPLE” represents “Savings Incentive Match Plan for Employees,” and “IRA” is for “Individual Retirement Account.”

4 Questions About ERISA You Must Know

In 1974 to protect the retirement assets of workers in the U.S. the Employee Retirement Income Security Act (ERISA) got formed. The ERISA implemented rules to be followed by qualified plans to ensure that plan fiduciaries do not misuse plan assets.

The Beginners Guide to Understand 403 B Plan – Overview

For some employees of public schools and tax-exempt organizations, a 403 B plan is a retirement account. Teachers, school administrators, professors, government employees, nurses, doctors, and librarians are the members of this 403 B plan.

The Beginners Guide to Understand 401 K Plan – Overview

A 401 K plan is named after a section of the U.S. Internal Revenue Code, it is a defined-contribution retirement account provided to employees by their employers. Through automatic payroll withholding, the workers can contribute to their 401 k accounts similarly their employers can match some or all of the contribution.

What is Section 7702 And What Is Its Importance? – Expert Guide

A section 7702 plan is a life insurance policy. The main purpose of life insurance is to protect your loved ones from financial hardship however some forms of life insurance can be used for investing and retirement. So if you are searching for a retirement plan then the 7702 will not be of use to you.

How to Build Equity in a Home – The Complete Guide

When you’re a homeowner, the mortgage payments that you make every month can help you build a powerful asset which is your home equity. The home equity acts as the amount of your home that you own, and it keeps growing over a period of time.

How to Build Equity in a Home – The Complete Guide

When you’re a homeowner, the mortgage payments that you make every month can help you build a powerful asset which is your home equity. The home equity acts as the amount of your home that you own, and it keeps growing over a period of time.

What is a Modified Adjusted Gross Income and How to Calculate it?

In simplest terms, your Adjusted Gross Income (AGI) along with a few items, like exempt or excluded income and certain deductions are Modified Adjusted Gross Income (MAGI). To determine your eligibility for certain deductions, credits, and retirement plans IRS uses your MAGI is used by IRS. Depending on your tax benefit, the MAGI can vary.

All About Home Appraisal Process with 4 Easy Steps to Complete

A home appraisal process in simple terms is a type of home valuation through inspection and comparison of the said home with other recently sold homes from the area. It is necessary to get the home evaluated through an appraisal before you can buy, sell or refinance a mortgage loan.

What is Adjusted Gross Income (AGI) – The Incredible Guide

An annual gross income minus certain adjustments that the Internal Revenue Service uses to determine your income tax liability for the year is your adjusted gross income (AGI)

10 Bad Financial Habits You Need to Break Today

Our habits are the everyday tendencies and activities we tend to do every day, sometimes without even consciously thinking about them. Let us take a look at 10 such bad financial habits that you need to break.

Is Hybrid Mortgage (ARM) Right for You? – The Pros and Cons

There are two popular home loan products, which are fixed-rate mortgages and adjustable-rate mortgages. In a fixed-rate mortgage, the interest rate for the entire life of the loan is fixed. A hybrid mortgage has features of both fixed and adjustable loan types.

What is Piggyback Mortgage (80-10-10 loan)

Besides a borrower’s first mortgage loan, any additional mortgage or loan that is secured with the same collateral is called a piggyback mortgage. Home equity loans and home equity lines of credit (HELOCs) are the common types of piggyback mortgages.

Take Advantage Of Home Equity Loan With Bad Credit – Best Tips

In such a case, a home equity loan may be the solution for you. Even with a bad credit score, it is very likely that the home equity loan will get approved, and you can also get a lower interest rate compared to a traditional loan or a line of credit.

The Top Secrets About Junior Mortgage One Should Know

A junior mortgage is also called a second mortgage but it could also be a third or fourth mortgage like a home equity loan or lines of credit. The initial or primary mortgage will be paid down first in the case of a foreclosure.

What Is A Credit Utilization Ratio? How It Works

The amount of revolving credit you’re currently using divided by the total amount of revolving credit you have available is your credit utilization ratio. Meaning the amount you currently owe divided by your credit limit and is generally expressed as a percent.

How to Calculate LTV – The Loan to Value Ratio

If you’re getting a home equity line of credit, the quantity of obtainable equity you’ve got in your home plays a crucial role. The difference between the appraised value of your home and your current mortgage balance is known as your home equity.

What Is A Prepayment Penalty In Heloc?

Let us today try and understand what is a prepayment penalty is. It is much to a borrower’s own detriment months or years after signing mortgage loan documents.A prepayment penalty is a fee that is charged to a borrower if they pay off their mortgage too quickly either by refinancing, selling, or prepaying.

5 Ways to Consolidate your Debts

When multiple balances are wrapped into a single loan with a lower overall interest rate and more manageable repayment terms you will reduce your debt and that is what is called debt consolidation.

Understanding Your HELOC Draw Period

As the value of homes increases, their owners can take out loans against the equity they’ve built up in their homes. If you are in need of cash then a quick, easy source of funding is Home equity lines of credit or HELOCs.

Tips to Get a HELOC on Investment Property

It can be challenging for taking out a home equity line of credit (HELOC) on your main home. Though it is possible, but not any easier to get a HELOC on investment property that generates rental income.

A Home Equity Conversion Mortgage (HECM), and is the only reverse mortgage insured by the U.S. Federal Government and it is available through an FHA-approved lender. HECM is the FHA’s reverse mortgage program and it enables you to take out a portion of your home equity.

What is a Second Mortgage and its Pros and Cons

The second mortgage is a relatively self-explanatory term. However, it the one that is often open to misinterpretation and one that you definitely want to hear as you are planning to apply for a home equity loan.

How to Use VA Cash Out Refinance For Debts Consolidation

According to online studies, an average American household carries about $16,048 in credit card debt alone. The average interest on credit cards is close to 18%. In today’s post, we will discuss VA Cash out Refinance could be used by veterans to eliminate credit card debts.

What Is The New FHA Cash-Out Refinance Update?

As we see a substantial increase in home values, more and more homeowners are accumulating a good amount of equity in their homes. With this increase in home equity, homeowners get an opportunity to access their equity and get cash-out for their use.

Using Home Equity for Retirement Income

Have you looked up the value of your real estate lately? Home values have gone up tremendously over the past few years. And it is excellent news for retirees, in today’s post, we will discuss why. Today we will be talking about what the retirees should do when it comes to using home equity for retirement income, which they would need for the long term.

Texas Cash-Out Refinance 50(A)(6) Update

With the rising real estate market, homeowners can see a significant rise in their home equity. This means they have access to more money, which they can use for their significant expenses from their home equity

Get Qualified for a HELOC In Texas by Knowing These 5 Important Steps

A Home equity line of credit is one of the most popular loans out there. A HELOC is a mortgage that, in many cases, will provide up to 80% of your equity amount in your home. The amount of equity that you can borrow against will vary from lender to lender.

Best and Worst Home Equity Uses In Texas

Home equity is your share of money in your home. Equity is a return on the investment in your home, and tapping it is not a light decision to make.There are good reasons to use your home equity, but there are some reasonably bad ones too. Lets us discuss some best and worst home equity uses in Texas.

How To Use Home Equity For Home Improvement Project In Texas

Everyone has to live somewhere and, everyone has to invest their money in someplace. So what happens when where you live, meets up with where your money is invested? In this post, we will discuss how to use home equity for home improvements and things to know before using it for remodeling.

How to Get Cash-Out Refinance On Rental & Investment Property In Texas

Today we will discuss passive income and why banks want to give money to you on your rental properties. You probably took a mortgage on a rental property when you bought it.But the banks like the properties which are purchased on cash so that you have some skin in the game and you own that rental home upfront.

Tips To Building Home Equity in Your New Home in Texas

It’s out there. Buying a new home is one of the most intriguing processes. There is too much thought which goes in when looking to buy a new home. When it comes to real estate, you are looking for a comfortable place to live, at the same time, it should also be a sound investment.

Cash-out Refinance vs HELOC In Texas

Over the last couple of years, the average home value has seen a substantial increase. Due to this, many people are trying to tap into their equity for home improvement, to get a down payment for a second home, consolidating debts, etc.

5 Incredible Benefits Of A Cash-Out Refinance In Texas

Cash-out refinances could be the best possible way to cover your major expenses. If you have built enough equity in your house, you could utilize this equity for various reasons.Listed below is the expert’s advice on the benefits you could gain if you opt for a cash-out refinance in Texas.

How To Grow and Use Home Equity In Texas?

In this post, we will understand what is home equity is and how to grow and use the equity in Texas.Home equity is one of the most common phrases used in real estate.

Understanding Home Equity Loans In Texas

Many homeowners want to know information about their home equity and how to use it. What are the home equity loan products available for their major expenses? Let us understand two types of home equity loans in Texas, and why would you need them.